Maiden voyage of the “Hamburg Express” from Asia to Hamburg. With a length of almost 400 meters and a slot capacity of 23,664 standard containers, she and her 11 sister vessels are among the largest cargo ships to ever sail under the German flag. Their innovative dual-fuel engines significantly reduce CO2 emissions and other pollutants.

Interview

“Quality is and will continue to be our top priority.”

quality is and will continue to be our top priority.”

“

Executive Board

-

CFO & CPO

Mark Frese -

CIO & CHRO

Donya-Florence Amer -

CTIO

Dheeraj Bhatia -

CEO

Rolf Habben

Jansen -

COO

Dr. Maximilian Rothkopf

The Executive Board in the engine room of the “Hamburg Express.” The dual-fuel engine, which can be seen in the background, has an output of around 79,000 hp and can be operated with both conventional bunker oil and liquid gas. This enables the ship to transport over 200,000 metric tons of cargo.

At a Glance

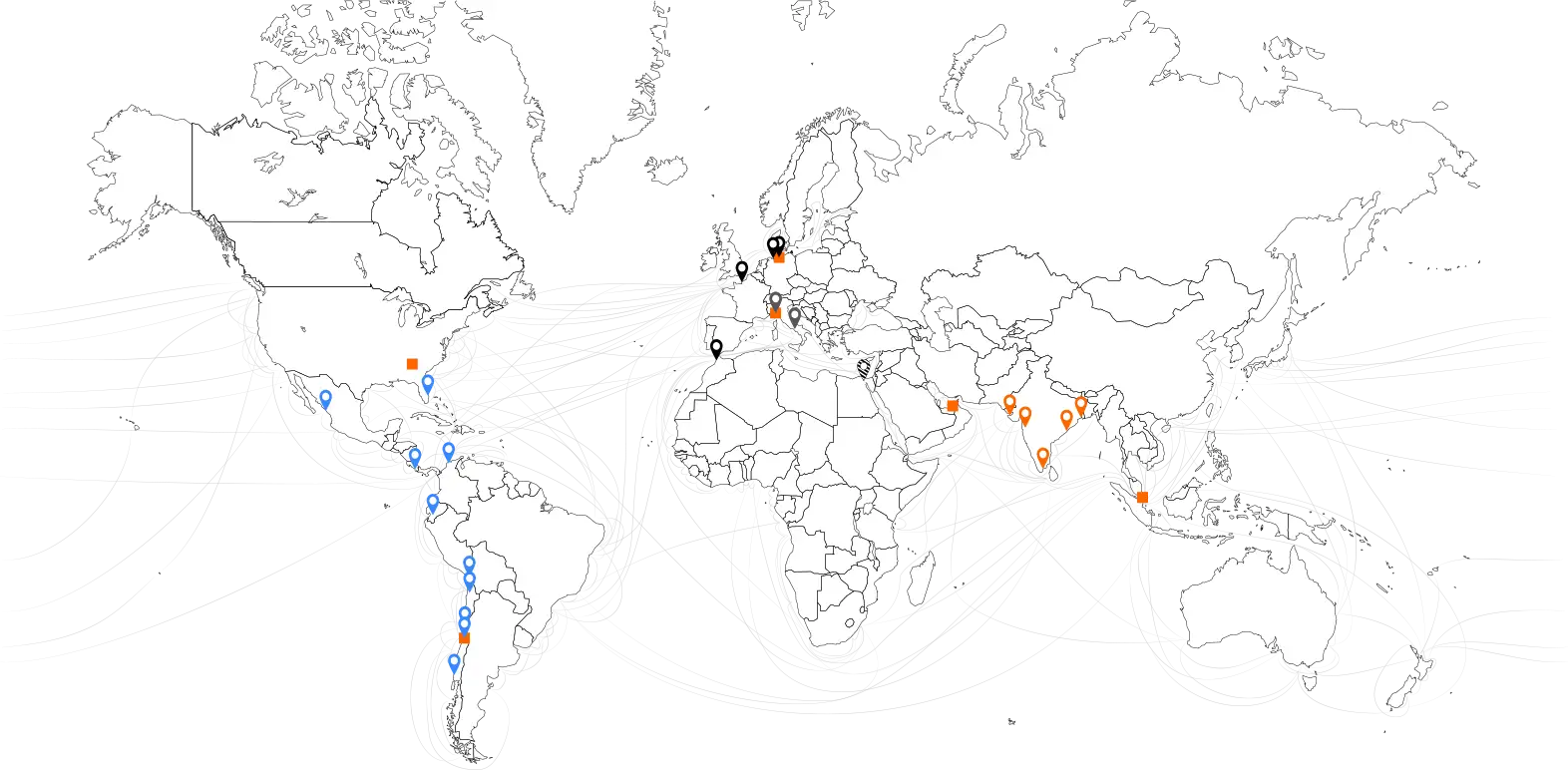

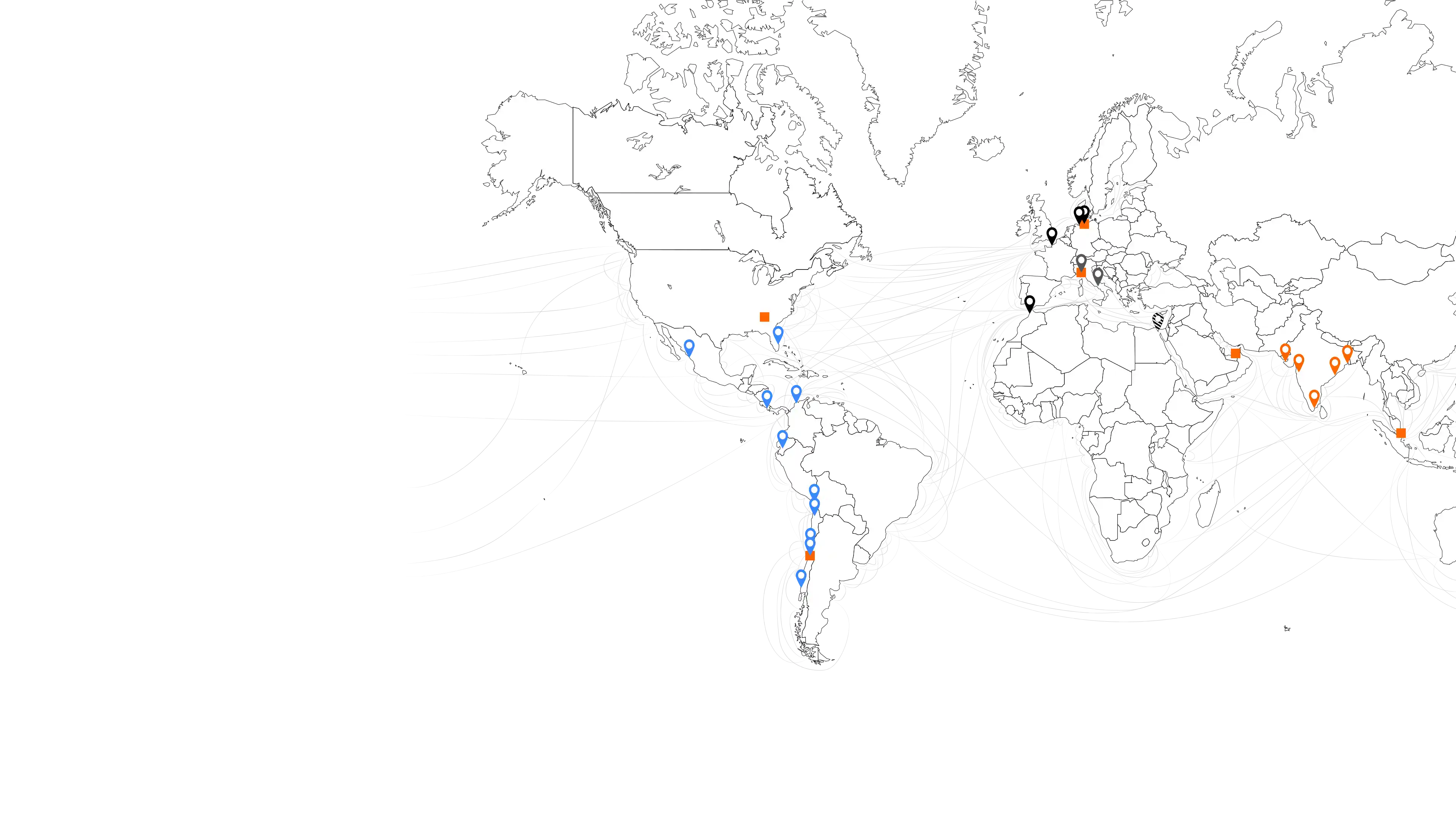

We are one of the leading container liner shipping companies and a global terminal operator. Our liner network connects over 600 ports on five continents. At the same time, we are continuing to expand our hinterland business with door-to-door transports. In doing so, we are making a decisive contribution to keeping global supply chains intact.

Liner Shipping

Terminal & Infrastructure

Strategy 2030

In 2024, we presented our new “Strategy 2030.” While we are remaining true to our core business of liner shipping, we are expanding and strengthening it as part of our “Pure Play Plus” model by establishing the new Terminal & Infrastructure business segment, with the aim of providing even better connections from port to port or door to door. In addition, we have ambitious growth targets in both areas of business. To achieve this goal and live up to our claim of being the “undisputed number one for quality,” we put our customers at the center of everything we do.

Team

The Hapag-Lloyd family includes around 17,000 dedicated individuals across the world – both on land and at sea. Together, we represent more than 100 nationalities and embody the diversity that makes us strong. Our corporate values – “We Care. We Move. We Deliver.” – are at the heart of everything we do and inspire us to give our very best every day – for our customers, our business partners and our shareholders.

Hapag-Lloyd Academy

In 2024, we made significant investments in enhancing our expertise – not only by expanding our Hapag-Lloyd Academy, but also by raising it to a higher level with several new training courses. Our objective is clear: to become the undisputed number one for quality. With their passion and engagement, our employees are the ones who make this possible every day.

We Care

As an internationally active liner shipping company, we operate in a highly competitive environment and have to quickly adapt to the geopolitical developments that impact us. At the same time, keeping our customers’ supply chains intact demands a great deal from our employees. As a company, we are committed not only to delivering quality service to our customers, but also to fostering a fair and appreciative working environment for our team as well as being socially engaged. Our top priority is ensuring the well-being and safety of our colleagues. For this reason, in 2024, we stood by our decision not to sail any more ships through the Red Sea as long as the safety of our seafarers cannot be guaranteed.

We also supported local social and ecological projects last year as part of our Hapag-Lloyd Cares initiative. Our teams around the world are committed to supporting educational programmes, humanitarian aid and the protection of the oceans.

Financials

Main developments in the 2024 financial year

Hapag-Lloyd recorded a positive business performance in the 2024 financial year

that significantly exceeded the initial expectations at the beginning of the year, despite increased transport expenses.

Group revenue increased by 6.6% to EUR 19.1 billion in the 2024 financial year (2023: EUR 17.9 billion) due to the positive demand development in both business segments.

Group EBITDA improved slightly to EUR 4.6 billion (2023: EUR 4.5 billion) and Group EBIT to EUR 2.6 billion (2023: EUR 2.5 billion). The increase in revenue was partially offset by higher transport and terminal expenses.

The Liner Shipping segment generated EBITDA of EUR 4.5 billion in the 2024 financial year (2023: EUR 4.4 billion) and EBIT of EUR 2.5 billion (2023: EUR 2.5 billion).

Transport volume increased by 4.7% to 12.5 million TEU (2023: 11.9 million TEU),

while the average freight rate of USD 1,492/TEU was on a par with the previous year (2023: USD 1,500/TEU). At the same time, the necessary rerouting of ships around the Cape of Good Hope in particular led to a disproportionate increase in transport expenses of 7.3% to EUR 12.8 billion (2023: EUR 11.9 billion).

In the Terminal & Infrastructure segment, EBITDA rose to EUR 139.5 million (2023: EUR 46.0 million) due to several acquisitions in the course of the previous financial year. At EUR 66.3 million, EBIT was also significantly higher than the previous year‘s figure (2023 *: EUR 16.5 million).

Despite a slight increase in the operating result, the Group net result declined to

EUR 2.4 billion in 2024 (2023: EUR 2.9 billion). This was due to lower net interest

income and higher tax expenses. Accordingly, earnings per share fell to EUR 13.57, compared to EUR 16.70 in the same period of the previous year.

Free cash flow was again positive at EUR 2.4 billion (2023: EUR 3.3 billion).

As at 31 December 2024, the Hapag-Lloyd Group had net liquidity of EUR 0.9 billion (31 December 2023: EUR 2.6 billion) despite a dividend payout of EUR 1.6 billion and investments in the vessel and container fleet of EUR 2.2 billion.

In line with the existing dividend policy, the Executive Board and Supervisory Board propose to the Annual General Meeting on 30 April 2025 that a dividend of EUR 8.20 per share be distributed for the past financial year (previous year: EUR 9.25). This corresponds to a payout ratio in relation to Group profit of 60% (previous year: 55%).

For the 2025 financial year, the Executive Board expects Group EBITDA in a range of EUR 2.4 to 3.9 billion (previous year: EUR 4.6 billion) and Group EBIT in a range of EUR 0.0 to 1.5 billion (previous year: EUR 2.6 billion). In the light of very volatile freight rates and major geopolitical challenges, the outlook is subject to a high degree of uncertainty.

* The comparative information has been marginally adjusted. For further information, refer to section “Adjustments in the measurement period” in the notes of the consolidated financial statements.